1. Introduction

In the SAP FI module, Special General Ledger (SGL) transactions are used to direct accounting entries from customer or vendor accounts to a different general ledger account. This redirection helps in organizing and tracking transactions such as down payments and down payment requests, making them more structured, traceable, and controllable. This document provides a detailed explanation of how to define SGL indicators for both down payments and down payment requests, the transaction codes used, and the impact of these transactions on the process.

2. Basic Concepts in SGL Transactions

2.1 Definitions

Request: These are entries that do not create a real accounting record but are used for informational purposes. They are typically recorded in memo accounts for tracking purposes.

Example: Customer down payment request records are kept in memo accounts for informational purposes.

Down Payment: This is the amount received prior to the sale of goods or services and creates a real accounting entry.

Example: Down payment received from a customer is recorded as a real payment using the F-29 transaction.

2.2 Transaction Code

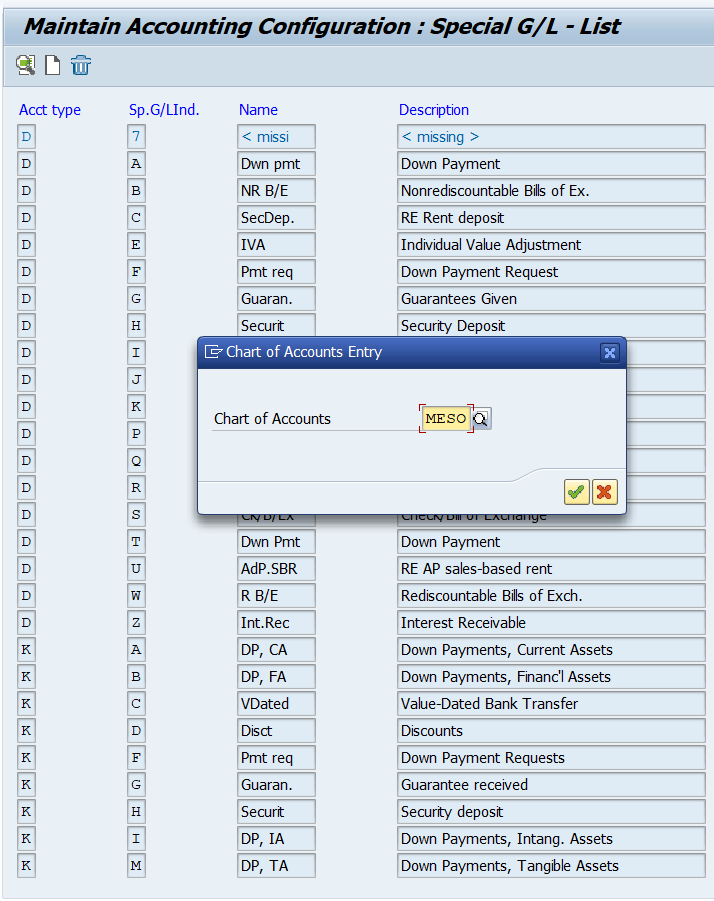

FBKP: This transaction code is used for defining and posting indicators related to down payments or down payment requests.

3. FS00 and Special G/L Account Setup (340 and 900 Accounts)

This section discusses the creation of special G/L accounts, specifically those starting with 340* and 900*, and how they are used in the system.

340 Accounts: Accounts beginning with 340 are used to post accounting entries related to down payments. These accounts are part of the balance sheet accounts and are classified under current liabilities. To ensure that customer down payments are accurately recorded and reported in financial statements, the 340* G/L account is created, which is designated as a Balance Sheet Account and a Recon Account for Acct Type: Customer.

The short description is "Customer Down Payment," and the long description is "Down payment/advance received from customers." The local currency is set to TRY, and Field Status Group: G031 and Short Key: 031 are assigned to ensure accurate posting.

This setup ensures that customer down payments are tracked separately, offering transparency and accountability in financial processes, while also enabling more efficient reconciliation and reporting.

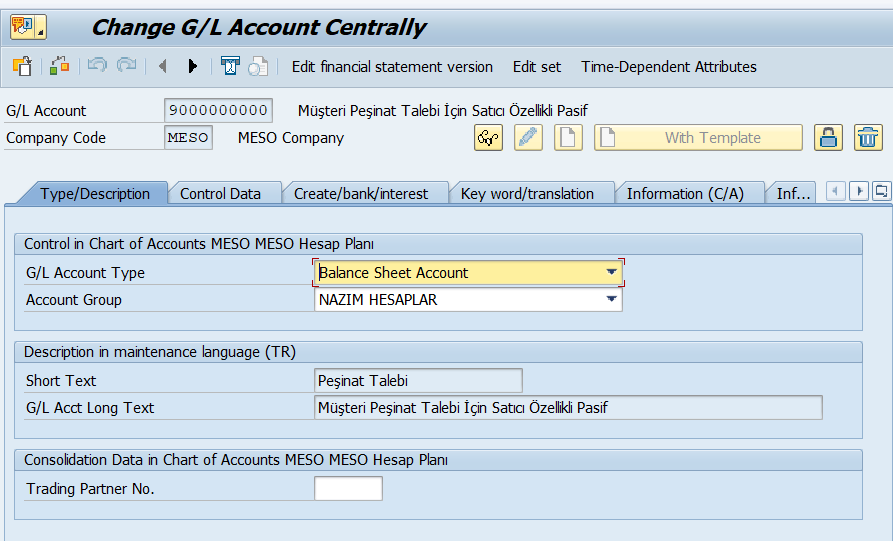

900 Accounts: Accounts starting with 900 are used for special accounting transactions or adjustments. These are used to track down payment requests before an actual payment is made. The 900* G/L accounts are defined under the "Memo Accounts" group and classified as Balance Sheet Accounts.

The short description is "Down Payment Request," and the long description is "Down payment request for customers with vendor characteristics." The local currency is set to TRY, and Recon Account for Acct Type: Customer is assigned to ensure proper reconciliation. Field Status Group: G067 is used to ensure proper posting.

This setup allows down payment requests to be tracked separately, preventing confusion with actual down payments. It also provides a passive account in financial reporting, ensuring consistency in reconciliation processes.

4. SGL Indicator Setup Process

4.1 Creating the Indicator

To create a new SGL indicator in the SAP system, follow the steps below:

In the SAP menu, go to the Special G/L section.

Click "Create" to create a new indicator.

Select the account type for the indicator (e.g., Fixed Assets (A), Customers (D), Vendors (K), Materials (M), Main Accounts (S)).

Enter the Special G/L Indicator and its description.

Upon confirmation, the system will guide you to the screen for assigning the relevant accounting accounts.

Enter the reconciliation account for the customer and specify the special G/L account where down payments will be posted.

4.2 Defining the Indicator’s Properties

After creating the SGL indicator, click on the "Properties" option to make additional adjustments. These properties will define how the transactions are processed and whether any alerts are triggered during the posting process.

Marked Items: Used for transactions that are informational in nature, and not included in the general ledger but can be marked for informational purposes.

Credit Limit Control Relation: SGL transactions may be excluded from credit limit control for the customer. Marked items are usually excluded from credit limit controls.

Open Item Warning: When posting to a customer or vendor account, the system will warn about the existence of a corresponding SGL transaction (e.g., a down payment).

Target Special Ledger Indicator: Specifies which SGL indicator will be used during document entry. In standard systems, this is used for down payment requests.

Special Ledger Transaction Class: Defines the type of transaction, such as down payment, promissory note, or other types.

Posting Key: Certain posting keys (e.g., 09, 19, 29, 39) are required for the SGL indicator to be valid.

Example Application: For down payments received from customers on account 120, when indicator "A" is used, the accounting entry is posted to the 340 account.

5. SAP SGL Customizations

5.1 Down Payment (D A) Setup

To define the Down Payment (D A) indicator, follow these steps:

Double-click the D A (Down Payment) indicator.

Enter your company code.

Define the customer accounts (starting with 120) and the corresponding 340 accounts.

If these accounts are not yet defined, use transaction FS00 to create them.

Click on "Properties" to make the necessary adjustments.

4.2 Down Payment Request (D F) Setup

To define the Down Payment Request (D F) indicator, follow these steps:

Double-click the D F (Down Payment Request) indicator.

Enter your company code.

Define the customer accounts (starting with 120) and the corresponding 900 accounts.

If these accounts are not yet defined, use transaction FS00 to create them.

Click on "Properties" to make the necessary adjustments.

6. Down Payment Process

6.1 Transaction Steps and Codes

F-29 (Down Payment Entry):Down payments received from customers are recorded using this transaction with special G/L indicator "A". This creates an actual payment entry.

Transaction Steps:

Document Date: Enter the transaction date.

Type: Select "DZ" (Customer Payment).

Company Code: Enter your company code.

Currency/Rate: Choose the appropriate currency and exchange rate.

Customer Account: Select the customer account.

Special G/L Indicator: Choose "A".

Bank Account: Enter the bank account.

Amount: Enter the down payment amount.

Value Date: Set the value date.

Save: Save the transaction.

FB70 (Customer Invoice Creation):This step records the invoice for the customer, either against the down payment or later.

Transaction Steps:

Invoice: Mark the "Invoice" checkbox.

Customer: Enter customer details.

Document Date: Enter the document date.

Amount: Enter the invoice amount.

G/L Account: Select the appropriate G/L account.

Save: After verifying the amount, save the transaction.

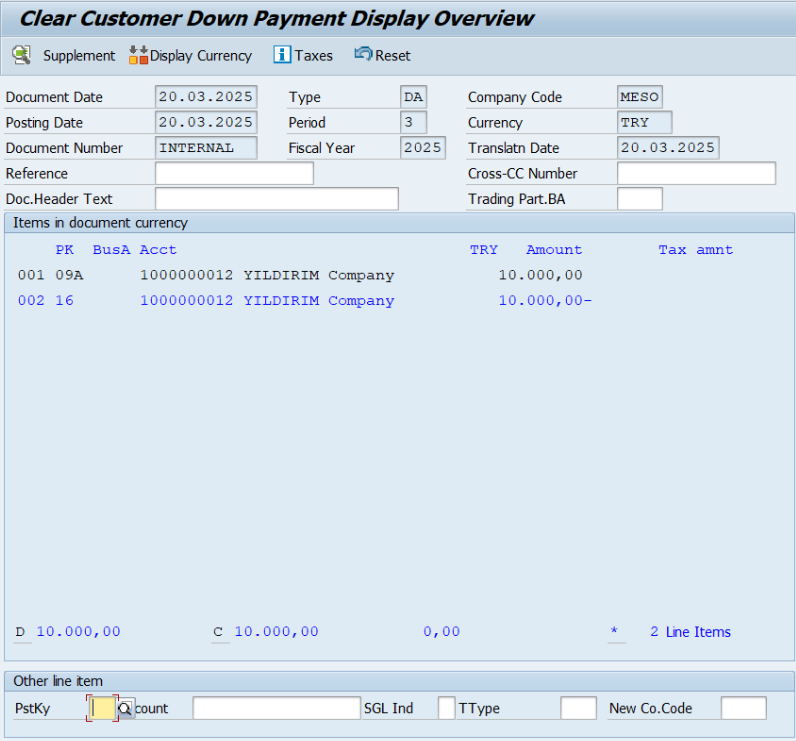

F-39 (Clearing):This transaction clears the down payment recorded in F-29 with the invoice created in FB70. It ensures that the down payment and invoice are reconciled.

Transaction Steps:

Document Date: Enter the document date.

Type: Choose the document type.

Company Code: Enter your company code.

Currency: Choose the currency.

Customer Account: Select the customer account.

Clearing: Choose the document to clear.

Save: Save the transaction.

F-32 (Customer Account Clearing):This transaction is used to clear open items in the customer account.

Transaction Steps:

Account: Enter the customer account.

Clearing Date: Enter the clearing date.

Company Code: Enter your company code.

Currency: Select the currency.

Process Open Items: Click this button.

Clearing: Select the open items to clear and save.

FBL5N (Customer Account Statement Review):This transaction is used to review the customer account statement, showing cleared and open items.

Transaction Steps:

Customer Account: Enter the customer account.

Company Code: Enter the company code.

Cleared Items: Mark this checkbox.

Clearing Date: Enter the clearing date.

Type: Select the document type.

Review: You can review cleared documents here.

Commenti